FinCEN’s BOI Reporting Deadline for Cape May County, NJ Businesses: File by 01/01/2025 to Avoid Daily $500 Fines

The Corporate Transparency Act (CTA) requires businesses across Cape May County, NJ, to report Beneficial Ownership Information (BOI) to FinCEN to enhance transparency and curb financial crimes.

As of today, 11-26-2024, Cape May County business owners have 36 calendar days (or 27 business days) left to file their BOI reports with FinCEN—delaying could lead to $500 daily fines.

Steps to Ensure BOI Compliance

1. Determine If Your Business Must File

Deadline: ASAP

Most corporations, LLCs, and similar entities must comply unless exempt. Exemptions apply to publicly traded companies, charities, and banks.

2. Identify Your Beneficial Owners

Deadline: 12-10-2024

A beneficial owner is anyone who:

-

Owns 25% or more of the business, or

-

Exercises substantial control over operations.

3. Gather Key Information

Deadline: 12-17-2024

Collect:

-

Business Details: Name, EIN, address.

-

Owner Details: Full name, address, date of birth, ID number.

4. File Your BOI Report

Deadlines:

-

Existing Companies (before 2024): File by 01/01/2025.

-

New Companies (2024): File within 90 days of creation.

-

New Companies (2025 or later): File within 30 days of creation.

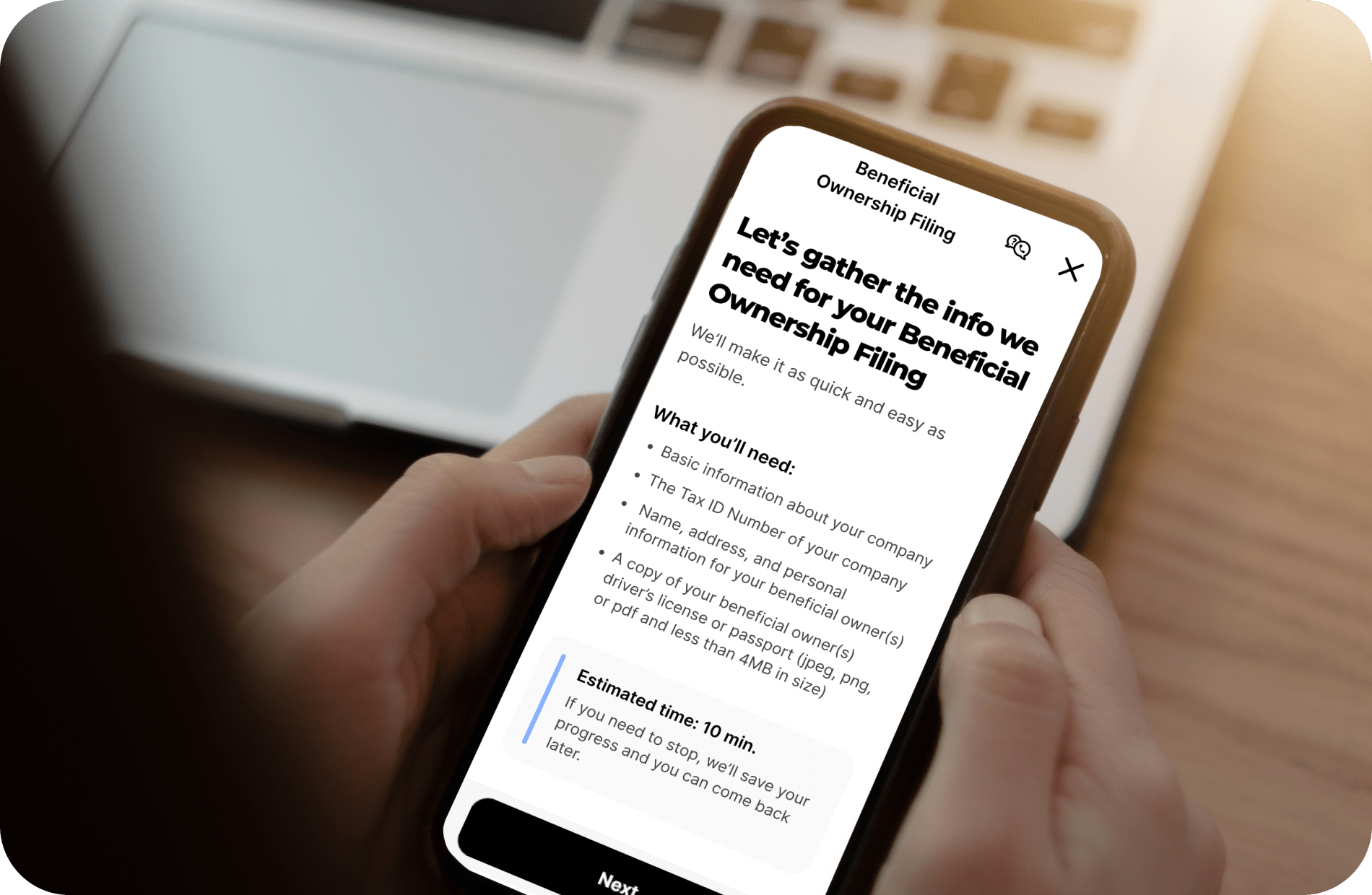

Let ZenBusiness streamline your BOI filing process. Start here!

More About BOI Filing

Who Needs to File?

Most small businesses in Cape May County, such as boutique hotels or local craft stores, are required to comply. Exemptions include larger entities like publicly traded companies or charities. For instance, a family-run Cape May beach rental company likely needs to file.

What Is a Beneficial Owner?

A beneficial owner holds significant control or a substantial ownership stake in a business:

-

Owns 25% or more equity, or

-

Exercises operational control.

Example: A Cape May café with three co-owners—two owning 40% each and one with a smaller stake but handling operations—would identify all three as beneficial owners.

Required Information

Your BOI report must include:

-

Business Info: Legal name, EIN, physical address.

-

Owner Info: Full name, home address, birth date, and government-issued ID details.

How and When to File

Submit BOI reports electronically via FinCEN. Deadlines depend on formation date:

-

Pre-2024 entities: File by 01/01/2025.

-

2024 entities: File within 90 days.

-

2025 entities: File within 30 days.

Penalties for Non-Compliance

Fines for late or false filings reach up to $500 per day and may include imprisonment. FinCEN allows a 90-day correction window for errors without penalty.

Let ZenBusiness Handle Your BOI Filing

ZenBusiness specializes in BOI compliance, saving you time and ensuring accuracy. Stay compliant and avoid penalties with their trusted services. Learn more and file today.

Additional Resources

Don't delay—secure your Cape May County business’s compliance by the January 1, 2025 deadline.